We’re Rewriting the Old Bedtime Stories

Because Life Insurance is More than Just a Death Benefit

Sleep Well – You’ve Got National Life

You’ve all heard the tales of life taking unexpected turns and planned protections falling short. It’s enough to make you lose sleep – that is unless you’re prepared. At National Life, we take the worry out of some of life’s biggest challenges and our Indexed Universal Life (IUL) Insurance has helped thousands of policyholders from across the country do just that. So, let’s open up a new book and learn about what an Indexed Universal Life Insurance Policy from National Life can do for you.

Concerned about your nest egg? You should read:

The Tale of the Goose and Her Nest Eggs

There once was a diligent goose,

Who saved part of all she produced.

For years she’s collected

Knowing she’d be protected.

Her nest eggs can not reduce!

Indexed Universal Life Insurance not only provides a death benefit - it also has the potential to build cash value that could be used to supplement your retirement income using policy loans and withdrawalsThe use of cash value life insurance to provide a resource for retirement assumes that there is first a need for the death benefit protection. The ability of a life insurance contract to accumulate sufficient cash value to help meet accumulation goals will be dependent upon the amount of extra premium paid into the policy, and the performance of the policy, and is not guaranteed. Policy loans and withdrawals reduce the policy’s cash value and death benefit and may result in a taxable event. Surrender charges may reduce the policy's cash value in early years.. We believe your hard-earned money shouldn't be vulnerable to the whims of the market. Indexed universal life insurance offers the protection of a "floor"The 0% or 1% “floor” provided by an indexed universal life policy ensures that during crediting periods where the index is negative, that no less than 0% or 1% interest is credited to the index strategy. However, monthly deductions continue to be taken from the account value, including a monthly policy fee, monthly expense charge, cost of insurance charge, and applicable rider charges, regardless of interest crediting. so that a decline in the index won't reduce your nest egg.

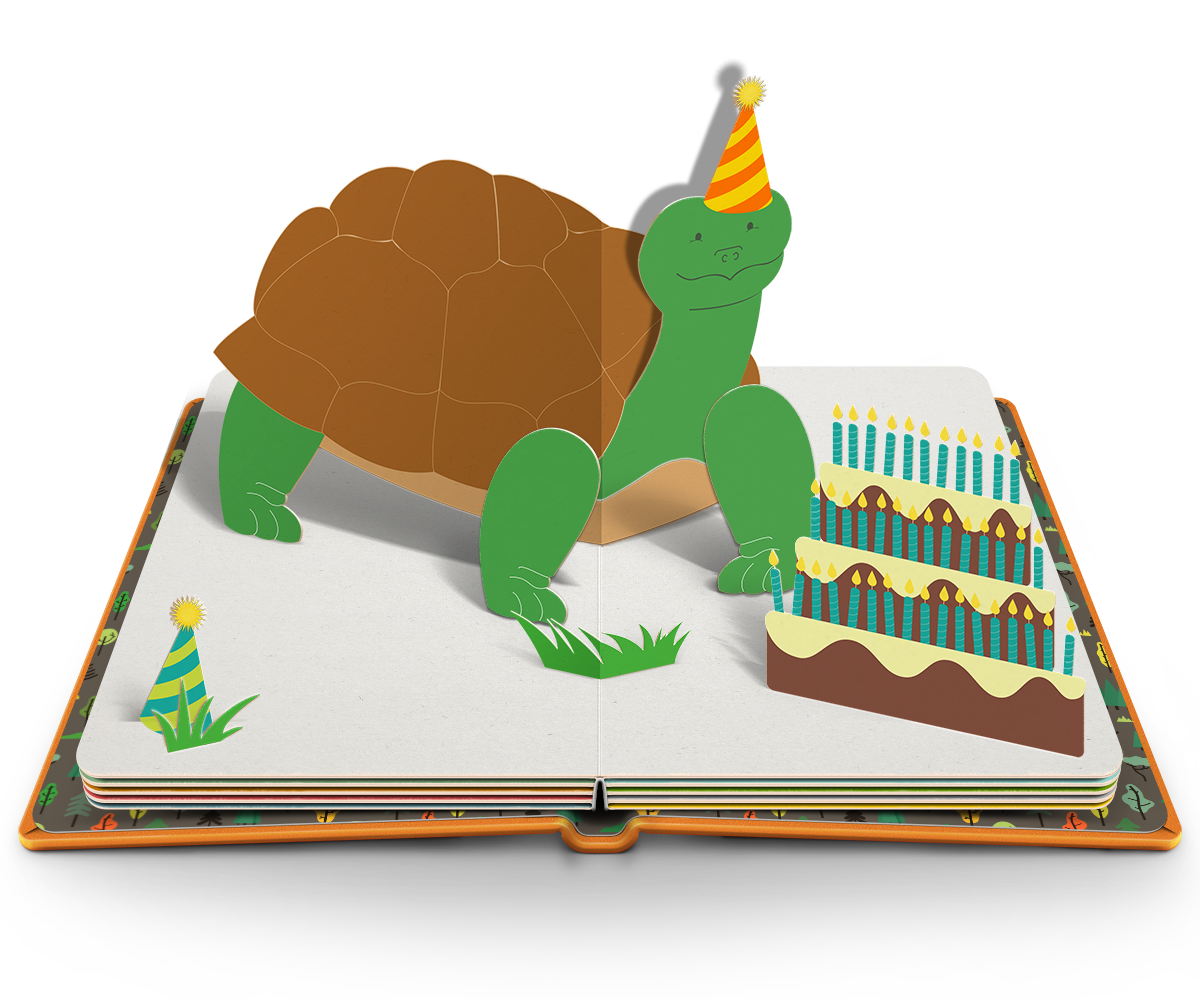

Worried you'll outlive your savings? You should read:

The Tale of the Tortoise's Birthdays

There once was a tortoise named Reed

Who marked many birthdays indeed.

And as his years doubled,

He never was troubled,

He had income for life guaranteed!

You should have the opportunity to live a long and happy life without worrying about money. Indexed universal life insurance not only provides a death benefit - some also offer features that can potentially provide an income for lifeLifetime income may be provided by a life insurance income rider. Life Insurance income riders typically have limitations and restrictions to exercising them, including but not limited to, minimum and maximum age requirements, years policy has been in force and minimum policy values. Receipt of other policy benefits that reduce policy values may also reduce the ability to exercise the income rider. Receipt of income benefits will reduce the policy’s cash value and death benefit, may reduce or eliminate the availability of other policy and rider benefits, and may be taxable. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products..

Is fear of injury keeping you grounded? You should read:

The Tale of the Jay with a Back-Up Plan

There once was a jay we’ll call Zach

A parachute he was sure not to lack.

Through thin or through thick,

In case he got sick,

His benefits still have his back.

Indexed universal life insurance not only provides a death benefit - it also offers features called living benefitsLiving benefits are provided by no-additional premium accelerated benefit riders. Payment of Accelerated Benefits will reduce the Cash Value and Death Benefit otherwise payable under the policy. Receipt of Accelerated Benefits may be a taxable event, may affect your eligibility for public assistance programs, and may reduce or eliminate other policy and rider benefits. Please consult your personal tax advisor to determine the tax status of any benefits paid under this rider and with social service agencies concerning how receipt of such a payment will affect you. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products. that let you access your death benefit, while living, in the event of a serious, qualifying illness. What's more, these living benefits can be used for any purpose.With some state exceptions.

Does the market keep you up at night? You should read:

The Tale of the Bull and the Bear

As the bull and the bear play their games

Well laid plans could go up in flames.

What goes up must come down.

Still, there’s no need to frown.

Your future is safe just the same.

Indexed universal life insurance not only provides a death benefit - it also has the potential to build cash value that earns interest based in part on changes in a market index, but with a "floor"The 0% or 1% “floor” provided by an indexed universal life policy ensures that during crediting periods where the index is negative, that no less than 0% or 1% interest is credited to the index strategy. However, monthly deductions continue to be taken from the account value, including a monthly policy fee, monthly expense charge, cost of insurance charge, and applicable rider charges, regardless of interest crediting. that ensures the cash value won't go down due to a decline in the index. We call this Upside Potential with Downside Protection.

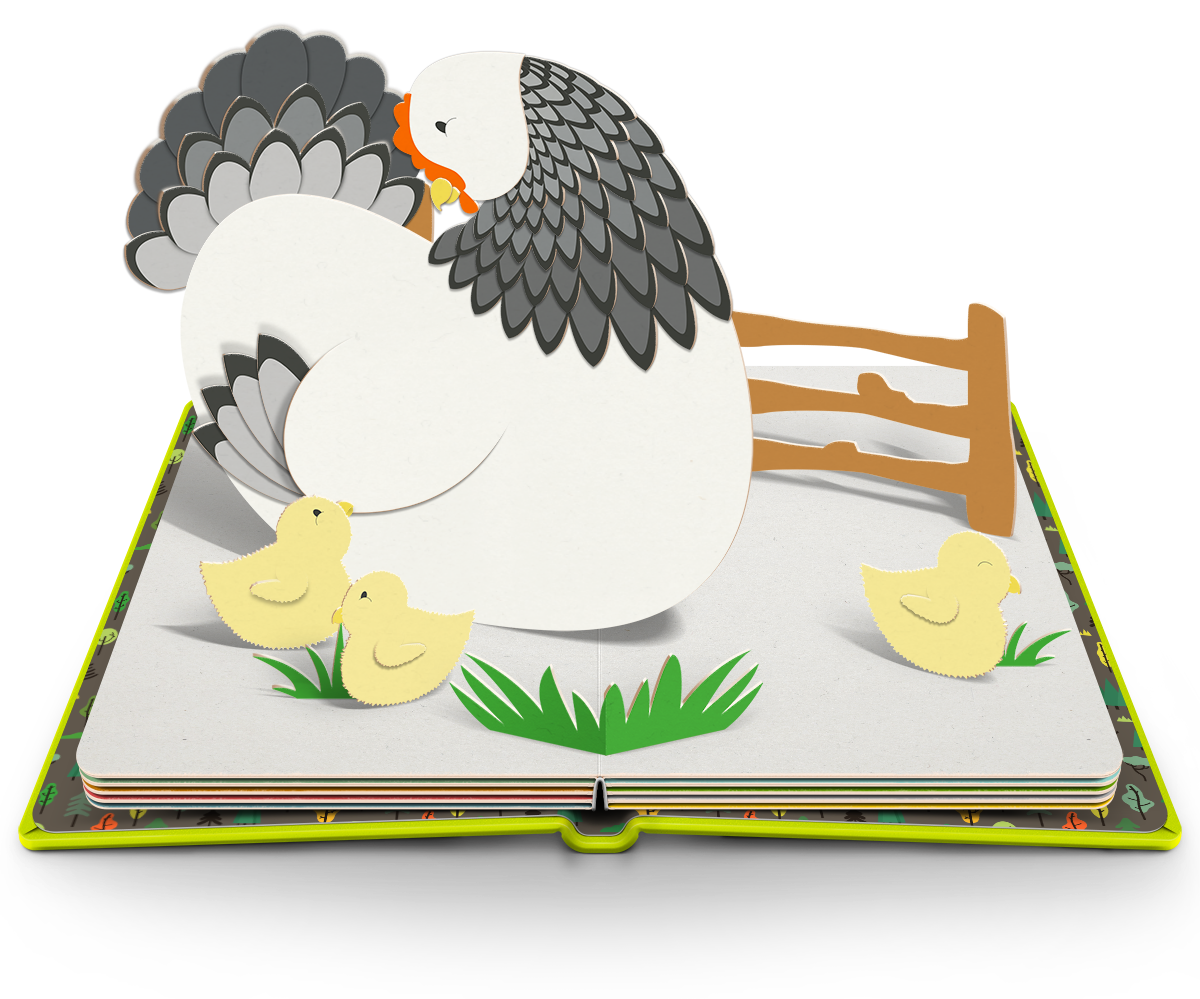

Worried about caring for your family when you're not around? You should read:

The Tale of the Mother Hen

There once was a mama named Grace

Whose nest was her brood's favorite space.

Her comfort was knowing

Generations ongoing

Could continue to flock in this place.

Death benefit protection comes first and Indexed Universal Life Insurance provides permanent tax-freeInternal Revenue Code § 101(a)(1). There are some exceptions to this rule. Please consult a qualified tax professional for advice concerning your individual situation. death benefit protection with flexible coverage and premiumsIt is possible that coverage will expire when either no premiums are paid following the initial premium, or subsequent premiums are insufficient to continue coverage. based on your needs. You can name anyone as a beneficiary, even a trust, to provide for future generations like Grace did.