National Life Group® is a trade name of National Life Insurance Company, founded in Montpelier, VT in 1848, Life Insurance Company of the Southwest, Addison, TX, chartered in 1955, and their affiliates. Each company of National Life Group is solely responsible for its own financial condition and contractual obligations. Life Insurance Company of the Southwest is not an authorized insurer in New York and does not conduct insurance business in New York.

|

No bank or credit union guarantee |

Not a deposit |

|

Not FDIC/NCUA insured |

May lose value |

Not insured by any federal or state government agency

Guarantees are dependent on the claims-paying ability of the issuing company.

- Among all reporting life insurance companies from 2014–2019 with individual life sales of at least $50M in 2014 — LIMRA Sales Reporting, 2019.

- LIMRA Sales Rankings, 4Q2019.

- Statutory basis benefits provided based on consolidated results of National Life Insurance Company (NLIC) and Life Insurance Company of the Southwest (LSW) for 2019. For NLIC only $401M.

- Based on the consolidated results of NLIC and LSW for 2019. For NLIC only life insurance weighted new annualized premium $53M, annuity weighted new annualized premium $9M, and single premium deferred annuities $1M.

- Based on consolidated results of NLIC and LSW. For NLIC only $50B.

- Based on consolidated results of all National Life Group (NLG) companies. This measurement only exists on a consolidated GAAP basis.

- Financial strength ratings for NLIC and LSW as of February 10, 2020. Ratings are subject to change.

- LIMRA US Individual Annuity Industry Sales Report, 4Q2019.

- Wink’s Sales and Market Report, 4Q2019.

- LIMRA Sales Rankings, 4Q2019.

- Based on consolidated results of all National Life Group (NLG) companies, and stated on a GAAP accounting basis excluding bond unrealized gains and losses. Statutory basis financial figures: NLG consolidated: Admitted Assets $35.6B and Liabilities $33.2B; NLIC only: Admitted Assets $10.1B and Liabilities $7.8B.

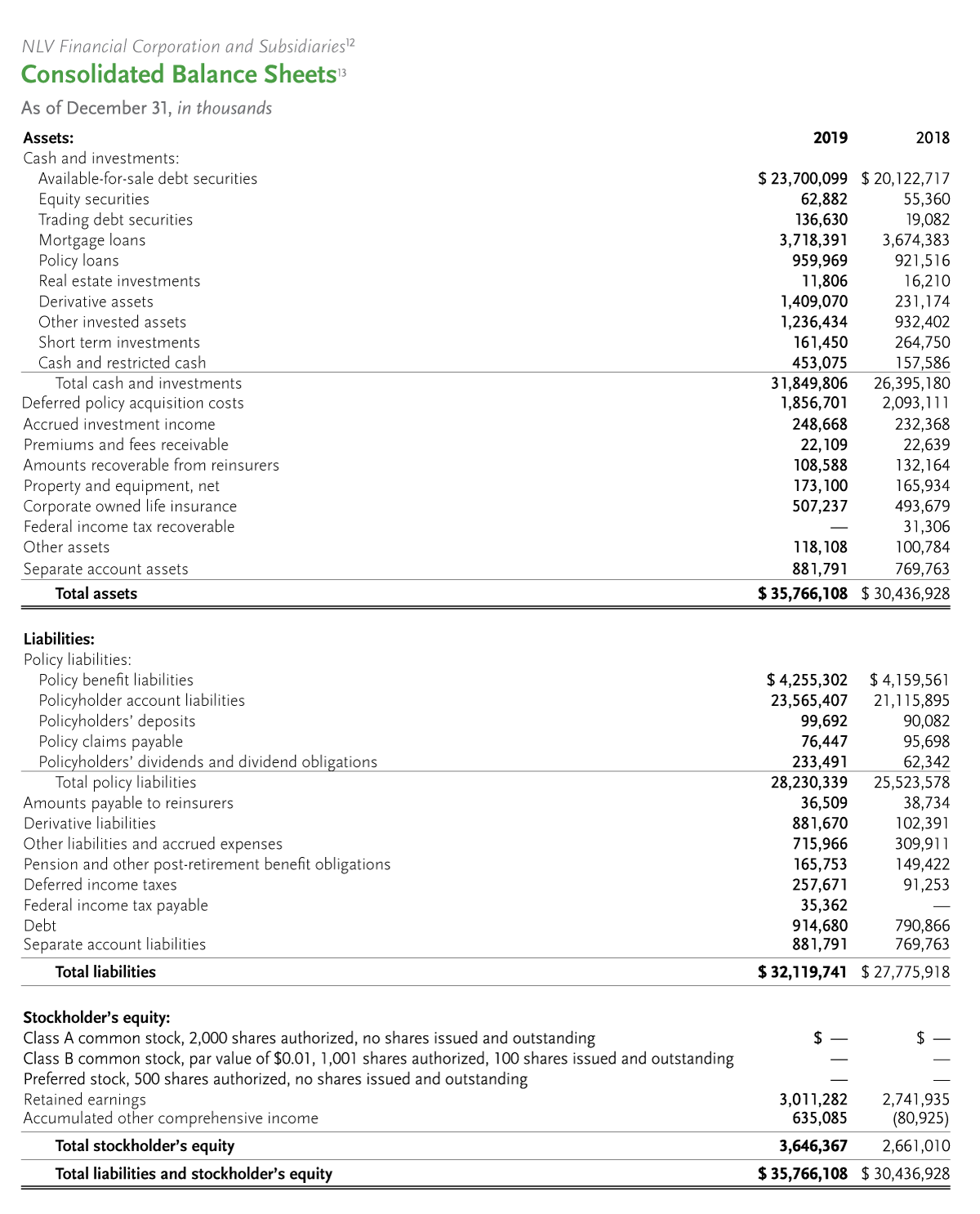

- Consolidated financial information on a GAAP basis for NLV Financial Corporation and its subsidiaries which include NLIC, LSW, Sentinel Asset Management, Inc., and Equity Services, Inc. See disclosures 13 and 14 for separate financial information pertaining to NLIC.

- Statutory basis financial information for NLIC only: Admitted Assets $10.1B, Cash & Invested Assets $8.7B, Liabilities & Reserves $7.8B, Policyholder Reserves $3.5B and Surplus to Policyholders $2.3B.

- Statutory basis financial information for NLIC only: Total Income $692M, Benefits & Expenses $645M and Net Income $40M.

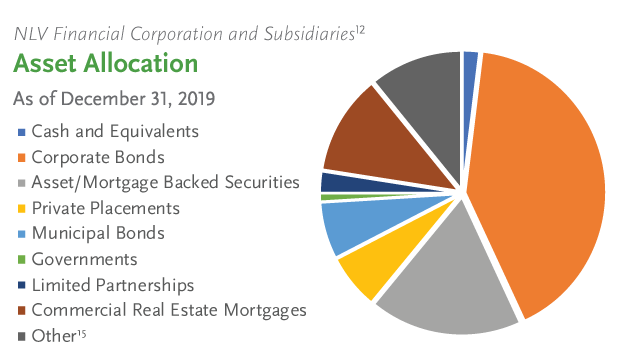

- Other includes Policy Loans, Derivatives, Unaffiliated Common Stock, Real Estate, and Housing Tax Credits.

This annual report summary of National Life Group (NLG) includes the consolidated results of NLV Financial Corporation and Subsidiaries, including National Life Insurance Company (NLIC), Life Insurance Company of the Southwest (LSW), Sentinel Asset Management, Inc., and Equity Services, Inc. Equity Services, Inc., Member FINRA/SIPC, is a Broker/Dealer and Registered Investment Adviser affiliate of National Life Insurance Company. In CO, MO, NH and WI, Equity Services, Inc. operates as Vermont Equity Services, Inc.

Click here to download a PDF file of the annual report.

To obtain a full version of the audited financial statements of NLV Financial Corporation and Subsidiaries, please send an e-mail to lifecustomerservice@nationallife.com or call our toll free number at (800) 732-8939.